Digital ID

R&D / discovery phase / Banking

As a member of a the Human-Centred Design team of a retail Bank, I supported multiple journey teams with research and user-centric processes. This case study focuses on a ‘Digital Identity’ work-stream - 4 cross-skilled people (myself + 1 x PM, 1 x tech lead, 1 x interaction designer), in a 6-week discovery phase.

Business goals

Give customers ‘control’ (view, manage, use) over their personal data.

Enable customers to use their data to on-board to new services - internal and external to the business.

My role:

Plan and conduct user research

Provide key insights and customer personas to the team

Facilitate and collaborate workshops to explore scenarios and propositions

APPROACH

Research objectives

Blue sky propositions as discussion points

1-2-1 formative interviews

Team ideation sessions

Conducting interviews (Qualitative, formative)

Participants were asked behavioural and attitudinal questions regarding sharing their personal information. Card sorting exercises were performed to help them explore and express expectations and attitudes on ‘trust’. Finally, we discussed 3 high level proposition statements to gather their initial thoughts and feedback.

Coding and highlights

I like to code qualitative research for pattern recognition.

Coding in spreadsheets

Highlights shared with the team whilst I’m coding

Reporting

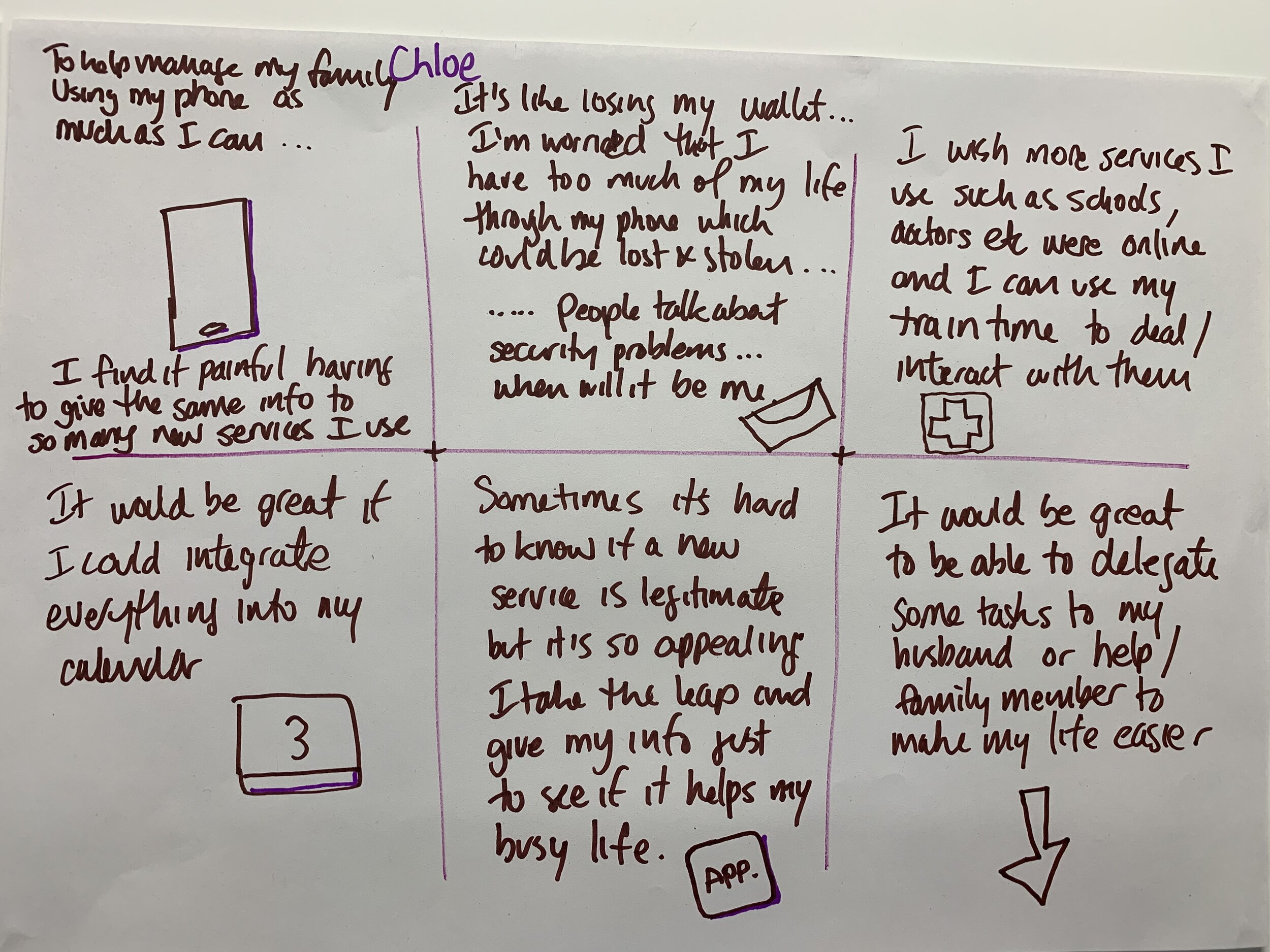

I created a report to play back to the team and share with stakeholders / wider business. The insights gave us ‘gains’ and ‘frictions’ to take into our ideas, as well as user archetypes.

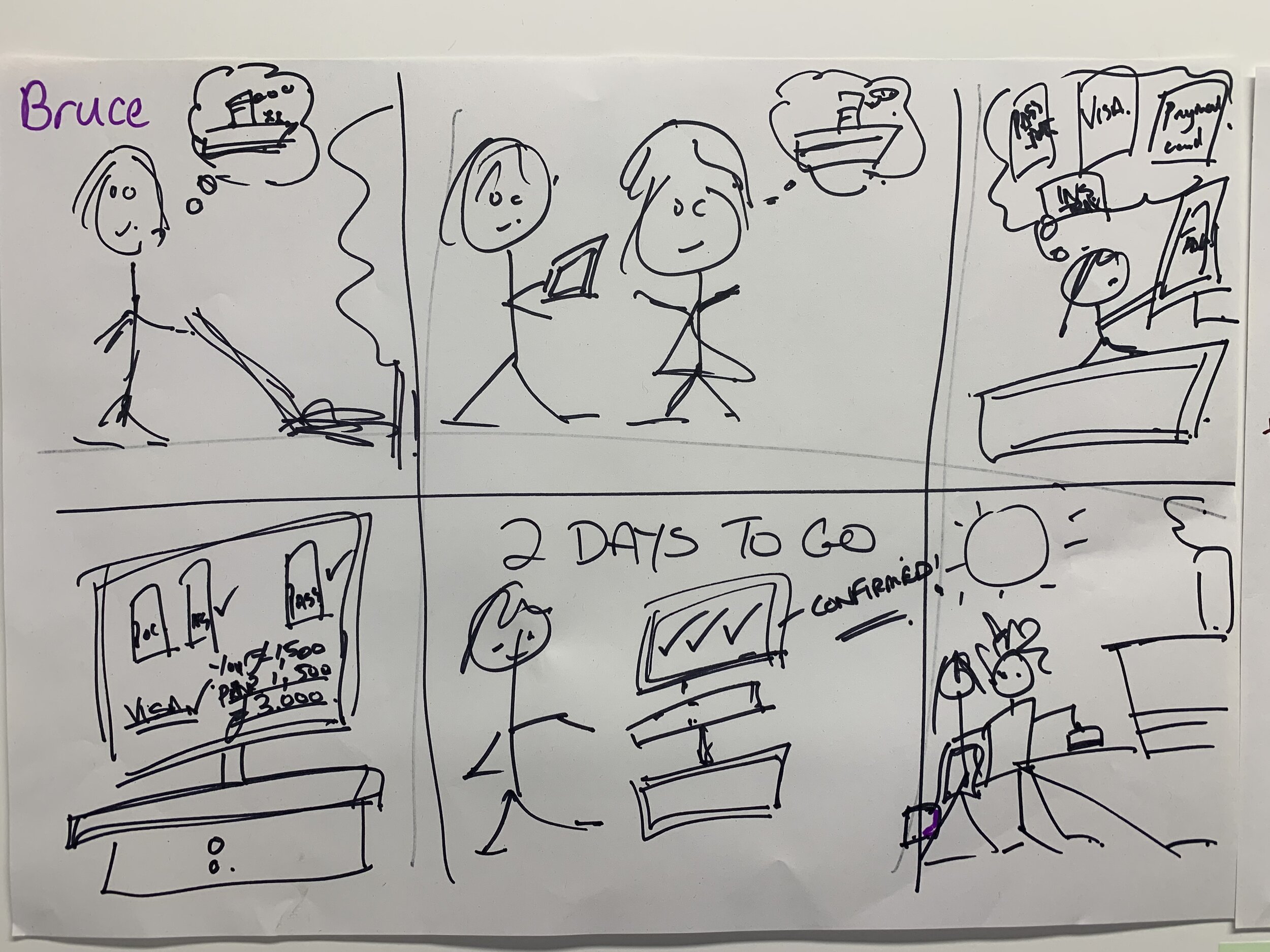

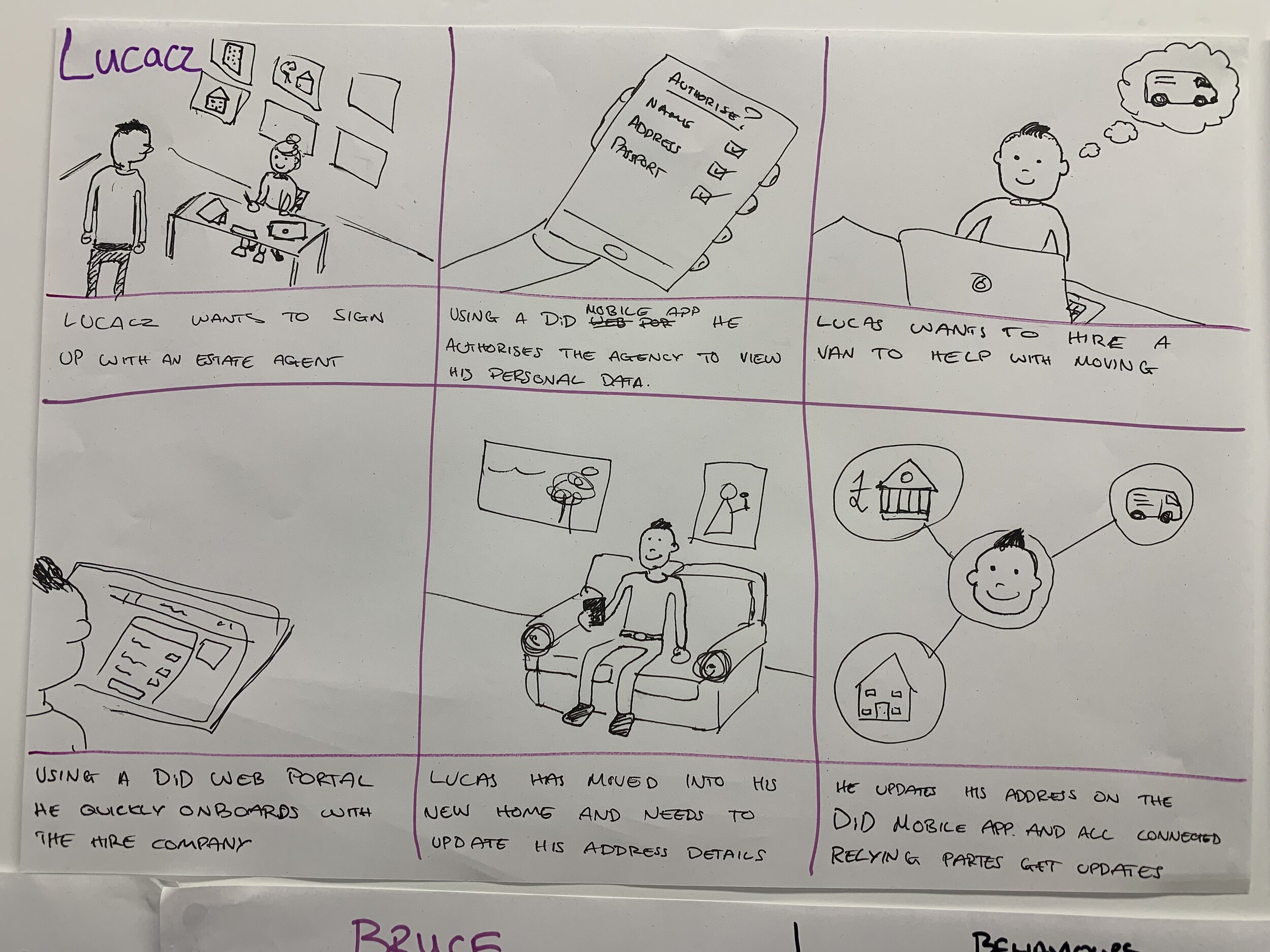

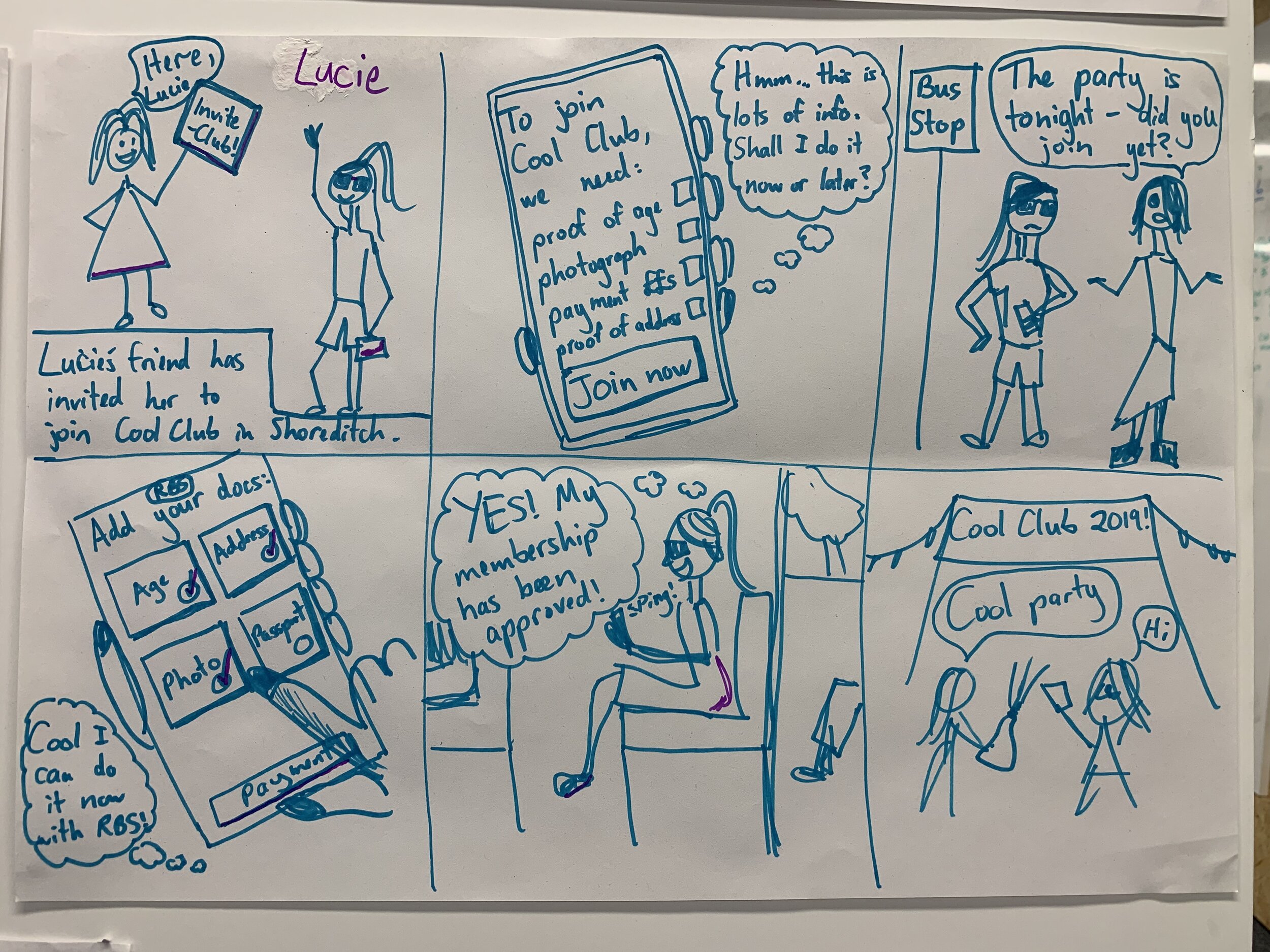

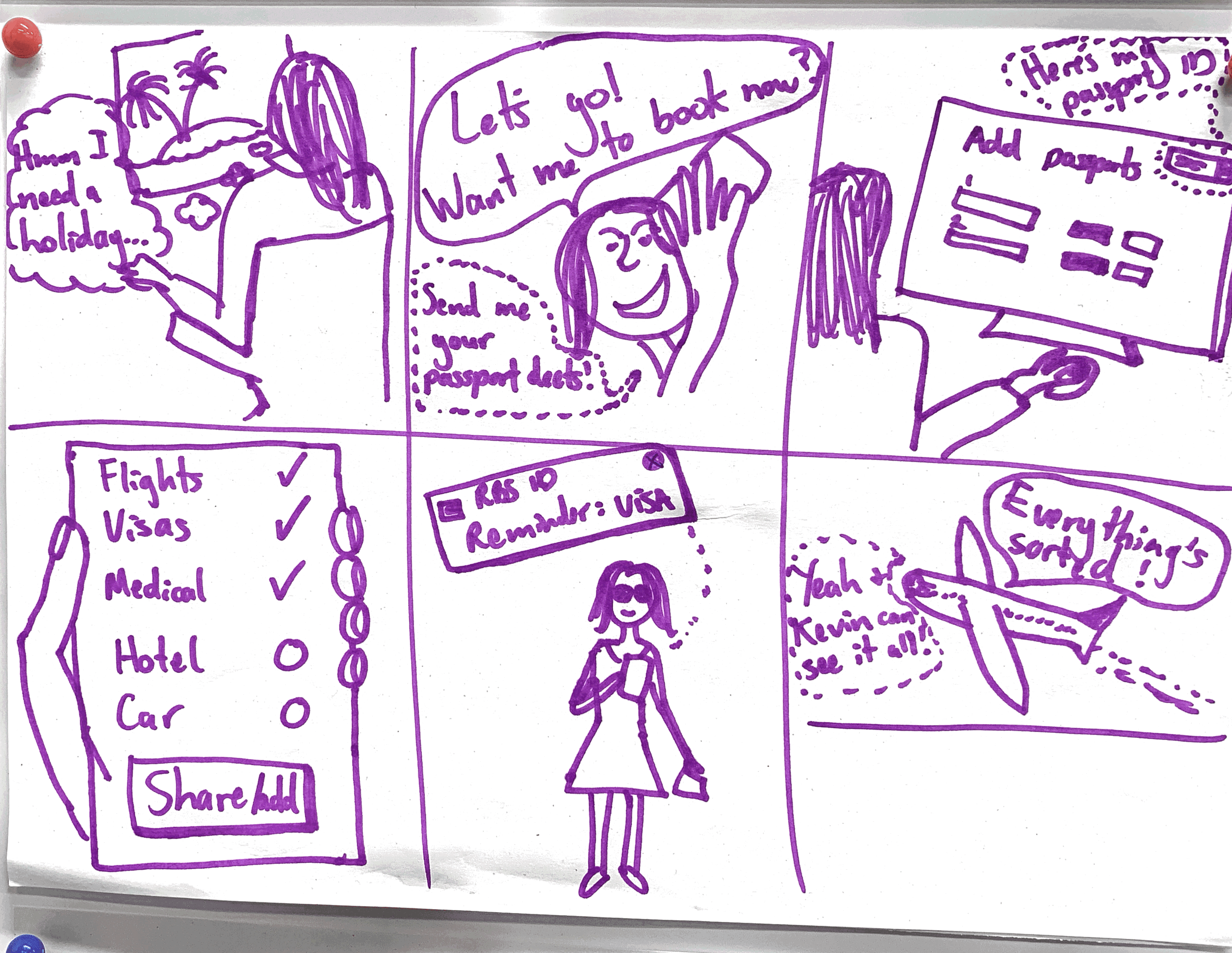

Ideation SESSIONS

We explored lots of ideas to a problem and solution ‘fit’ and created storyboards to flesh out scenarios and use cases. It was at this point I was moved to another team. This team went on to cristallise ideas into 4 or 5 propositions to present to stakeholders.